|

Agenda Item

ASR

Control 24-000648 |

||

|

MEETING

DATE: |

08/27/24 |

|

|

legal entity taking action: |

Board

of Supervisors |

|

|

board of supervisors district(s): |

All

Districts |

|

|

SUBMITTING Agency/Department: |

District

Attorney and Clerk-Recorder

(Approved) |

|

|

Department contact person(s): |

Matthew

Pettit (714) 347-8440 |

|

|

|

Keith

Bogardus (714) 347-0511 |

|

Subject: Approval of State Authorized

Increased Real Estate Fraud Prosecution Fee

|

ceo CONCUR |

County Counsel Review |

Clerk of the Board |

||||||||

|

Concur |

Approved

Resolution to Form |

Public

Hearing |

||||||||

|

|

|

3

Votes Board Majority |

||||||||

|

|

|

|

||||||||

|

Budgeted: N/A |

Current Year

Cost: N/A |

Annual Cost: N/A |

||||||||

|

|

|

|

||||||||

|

Staffing Impact: |

No |

# of Positions: |

Sole Source: N/A |

|||||||

|

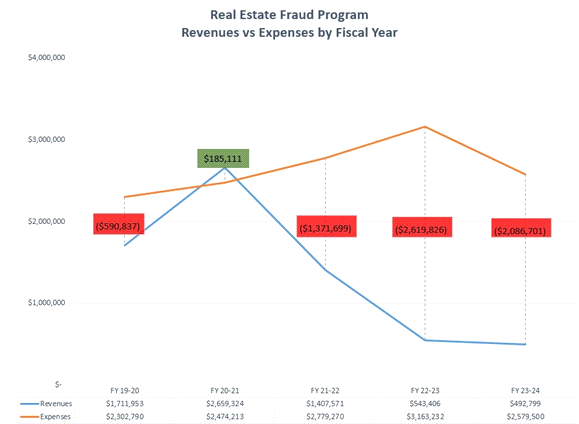

Current Fiscal Year Revenue: $492,799

|

||||||||||

|

Prior Board Action: N/A |

||||||||||

RECOMMENDED

ACTION(S):

|

1. |

Approve

the District Attorney Real Estate Fraud Prosecution Annual Report for FY

2023-24 pursuant to Section 27388, subdivision (d) of the California

Government Code. |

|

|

2. |

Find that the

proposed fee is Statutorily Exempt from the provisions of the California

Environmental Quality Act (CEQA) pursuant to Section 21080(b)(8) of the

Public Resources Code and Section 157273 of the CEQA Guidelines as the

establishment of modification of rates, fees and charges, which are for the

purpose of meeting operating expenses, including employee wage rates and

fringe benefits, purchasing or leasing supplies, equipment or materials as

set forth herein. |

|

|

3. |

Conduct

a Public Hearing. |

|

|

4. |

Adopt

a Resolution that: |

|

|

|

a. |

Rescinds

Resolution 24-017, effective October 1, 2024, and approves an increase in the

real estate fraud prosecution fee collected by the Orange County

Clerk-Recorder from $3 to $8 on certain specified real estate instruments

effective October 1, 2024 for a three-year term ending September 30, 2027, to

provide a continued funding source to investigate, prosecute and deter real

estate fraud crimes pursuant to California Government Code Section 27388. |

|

|

b. |

Increases

the allocation of the real estate fraud prosecution fee for reimbursement to

the Clerk-Recorder’s Office from five percent to ten percent, and authorizes

the Clerk-Recorder to transfer ninety percent of the fee into the District

Attorney Real Estate Fraud Prosecution Trust Fund. |

|

|

c. |

Finds

that the proposed fee meets the requirement set forth in subdivision (e)(3)

of Section 1 of Article XIII C of the California Constitution, and is

therefore exempt from the definition of a tax as used therein. |

|

|

d. |

Finds

that the fee bears a fair or reasonable relationship to the payor’s burdens

on, or benefits received from, the applicable governmental services and the

revenue resulting from the fee established under the resolution will not

exceed the estimated reasonable cost to provide these services. |

|

|

e. |

Authorizes

the Clerk-Recorder to collect the additional fees on behalf of Orange County.

|

SUMMARY:

Approving the District Attorney Real

Estate Fraud Prosecution Annual Report covering FY 2023-24, pursuant to Section

27388, subdivision (d) of the California Government Code, and increasing the

current real estate fraud prosecution fee from $3 to $8 will allow the continued

investigation and prosecution of real estate fraud crimes in Orange County.

Increasing the Clerk-Recorder’s maximum

reimbursable share of this real estate fraud prosecution fee from five percent

to ten percent as authorized by Government Code Section 27388, will recover the

costs of real estate fraud detection efforts administered by the

Clerk-Recorder.

BACKGROUND

INFORMATION:

On March 3, 2009, by Resolution No.

09-020, the Board of Supervisors (Board) authorized: 1) the establishment of

the Real Estate Fraud Prosecution Fund 12G to implement the provisions of

California Government Code Section 27388 to collect a $3 real estate fraud

prosecution fee on specified real estate instruments for the sole purpose of

enhancing the capacity of local efforts to investigate, prosecute and deter

real estate fraud crimes; 2) the Clerk-Recorder to begin collection of the fee

on April 13, 2009; and 3) the establishment of the Real Estate Fraud

Prosecution Committee composed of the County Executive Officer, the Clerk-Recorder

and the Orange County District Attorney (OCDA) to distribute funds from the

Real Estate Fraud Prosecution Fund 12G.

In response, the OCDA, in partnership with

the Clerk-Recorder, established a Real Estate Fraud Prosecution Program that is

funded (in part) by this $3 real estate fraud prosecution fee. The real estate

fraud prosecution fee is a one-time fee borne by and benefitting those who use

the government resource: it is paid, as part of a real estate transaction, by

an individual or entity recording a document relating to real estate. This is

the exact group that enjoys the advantages of having a dedicated Real Estate

Fraud Prosecution Unit to combat real estate fraud crime across Orange County.

Since the initial establishment of this

fee, the Board has approved five three-year extensions of the real estate fraud

prosecution fee. Prior Board actions are summarized in the table below.

|

Date |

Action |

|

3/20/2012 |

Adopted Resolution 12-028 extending $3 real

estate fraud prosecution fee. |

|

3/3/2015 |

Adopted Resolution 15-010 extending $3

real estate fraud prosecution fee. |

|

2/27/2018 |

Adopted Resolution 18-015 extending $3

real estate fraud prosecution fee. |

|

2/23/2021 |

Adopted Resolution 21-020 extending $3

real estate fraud prosecution fee. |

|

2/27/2024 |

Adopted Resolution 24-017 extending $3

real estate fraud prosecution fee. Approved OCDA’s request to return to the

Board prior to three-year time period if the actual costs of administering

the Real Estate Fraud Prosecution Unit exceed the revenue collected. |

Real estate fraud has proven to be a

significant problem in Orange County, causing considerable harm and potentially

catastrophic financial losses for Orange County property owners. The Real

Estate Fraud Prosecution Unit is the primary law enforcement actor combating

these crimes in the county. The unit is

comprised of prosecutors, investigators and support staff with specialized

training and expertise in real estate fraud that enables them to effectively

investigate and prosecute real estate crimes. The Real Estate Fraud Prosecution

Unit handles an average of 100 reports of potential real estate fraud each

year.

The cases that are reported directly to

the Real Estate Fraud Prosecution Unit represent the vast majority of reported

real estate crime in Orange County. They also represent a serious criminal

threat to our local communities, with potential losses in the tens of millions

of dollars. In addition, real estate fraud cases are often referred to the Real

Estate Fraud Prosecution Unit from other law enforcement agencies. Over the

past three years, the Real Estate Fraud Prosecution Unit has worked closely

with local law enforcement partners, providing trainings and resources to local

agencies to ensure perpetrators of real estate fraud will be brought to justice

regardless of where those crimes are reported. Additionally, the Real Estate

Fraud Prosecution Unit is active in the community, meeting with concerned

groups, such as senior citizens and real estate professionals, to provide

insight and education for identifying, avoiding, combatting, and reporting real

estate fraud.

Two other key innovations made possible by

the real estate fraud prosecution fee and establishment of the Real Estate

Fraud Prosecution Fund are the Courtesy Notice program and the Real Estate

Fraud Prosecution Unit’s direct reporting portal. The innovative Courtesy

Notice program alerts homeowners via mail any time a document affecting title

to their property is recorded. This

system quickly notifies homeowners to changes to their property title, which in

turn allows them to discover and report any fraudulent activity to the OCDA

without delay. The direct reporting mechanism allows potential victims or

witnesses to real estate crimes to report directly to the Real Estate Fraud

Prosecution Unit for further investigation. This direct portal allows crime

victims to quickly reach subject matter experts who assess, investigate, and

prosecute these crimes.

Currently, investigators with the Real

Estate Fraud Prosecution Unit are actively investigating approximately 36 real

estate fraud cases. The attorneys are prosecuting approximately 25 filed felony

real estate fraud cases in which approximately 45 defendants are charged. Real estate fraud cases typically have tens

of thousands of pages of discovery, plus voluminous digital evidence. In

addition, the total restitution owed to victims in real estate fraud cases is

often over a million dollars. As a

result of the Real Estate Fraud Prosecution Unit’s efforts, over $25 million in

restitution orders have been awarded to real estate fraud victims in the last

three years. As one may deduce from these numbers, these cases are among the

largest and most complex cases the OCDA prosecutes, requiring extensive and

sophisticated litigation both before and after conviction.

All of these efforts to obtain justice for

Orange County real estate fraud victims have been made possible by the real

estate fraud prosecution fee. At the time it was first adopted in 2009, Orange

County’s $3 real estate fraud prosecution fee was the highest allowable fee

permitted by Government Code Section

27388; and in 2009, that $3 fee generally covered the costs of the Real

Estate Fraud Prosecution Program. However, over the past few years, the housing

market has seen significant inventory decline because of rising interest rates.

As a result, significantly fewer real estate documents are being recorded,

which means less revenue for the Program. On the other hand, Program expenses

increase slightly year over year for the past 15 years since the $3 fee was

first adopted. As a result, the Real Estate Fraud Prosecution Program has been

under-funded for the past several years, with a chasm between program revenues

and expenses.

Additionally, home prices have risen

substantially since the Program was implemented. In August of 2009, the median

sales price of a home in Orange County was $427,750 according to data provided

by the County Executive Office in the FY 2009-10 Adopted Budget. By June of

2023, the CEO’s FY 2023-24 Annual Budget reported that the median home price in

Orange County had nearly tripled to $1,260,000. Thus, the relative value of the

$3 real estate fraud prosecution fee has decreased by nearly 66% since the fee was

adopted in 2009. For the fee to represent the same percentage in relation to

the average home price as it did in 2009, the fee would need to be raised to

$8.84.

|

Year |

Median Orange County Home Sales Price |

$3 Fee in Relation to the Median Cost

of a Home in Orange County |

|

August 2009 |

$

427,750 |

0.00070% |

|

June 2023 |

$

1,260,000 |

0.00024% |

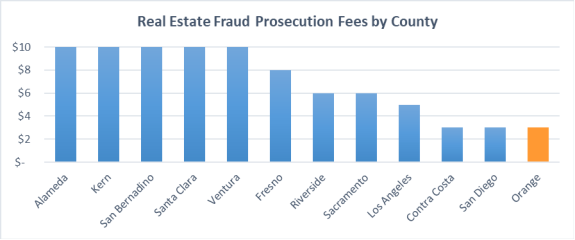

In 2012, Government Code Section 27388 was

amended to allow counties to increase the fee up to $10. California’s counties

have overwhelmingly opted to increase the fees. Among California’s twelve most

populous counties, nine have chosen to raise the real estate fraud prosecution

fee. Only Orange County, San Diego County, and Contra Costa County elected to

stay at the $3 level.

It is also worth noting that many counties

outside of the twelve largest counties have also chosen to raise the real

estate fraud prosecution fee to support real estate fraud investigation and

prosecution. Santa Barbara, Solano, and Marin Counties have all elected to

raise the fee to the $10 level. San Luis Obispo, Monterey, and San Joaquin have

each opted for fees in the $6 to $8 dollar range.

Government Code Section 27388 also

explicitly contemplates the reimbursement of the county recorder’s office for

their actual and reasonable administrative costs incurred in implementing the

Real Estate Fraud Prosecution Program. While the statute permits deductions of

up to ten percent of the fees paid pursuant to Government Code Section 27388,

the Orange County Board of Supervisors has capped the amount that can be

deducted to reimburse the Clerk-Recorder at five percent. As a result, the

Clerk-Recorder’s costs have exceeded their reimbursement for several years.

The Orange County Clerk-Recorder’s Office

has been one of the key partners of the OCDA’s Real Estate Fraud Prosecution

Unit in fighting real estate fraud crimes. It is supportive of investigation

and prosecution efforts and directly refers suspected fraudulent recordings to

OCDA for investigation. One example of

this fruitful partnership was a case in which a “Sovereign Citizen” recorded

multiple fraudulent quitclaim deeds on homes in which he had no ownership

interest. The Recorder’s Office recognized this as possible fraud, despite

being statutorily required to accept them for recordation, and alerted OCDA to

this potential crime almost immediately.

The OCDA was then able to quickly investigate and file charges against

that individual.

The Clerk-Recorder additionally plays a

pivotal role in the Real Estate Fraud prosecution program by alerting

homeowners to potential fraud by sending a courtesy notice, via USPS, to

homeowners any time a document affecting title to real property is recorded in

Orange County. Criminals engaged in real estate fraud tend to target the

elderly and unsophisticated. The real estate fraud trends in Orange County

suggest the current automatic, mail-based courtesy notice is an irreplaceable

tool for combating real estate crime in the County. In another example, OCDA

successfully investigated and filed criminal charges against an individual who

recorded multiple false documents on a property she previously lost to

foreclosure. OCDA was alerted to the false documents first by the

Clerk-Recorder, who recognized the documents as potentially fraudulent. OCDA

was then separately alerted to one of the two false documents by the subsequent

purchasers of the property, who received a Courtesy Notice in the mail shortly

after closing escrow.

This robust notification program cost the

Clerk-Recorder over $134,000 during Fiscal Year 2022-2023. In contrast, the

total recording volume was down significantly and thus, based on the $3 fee and

5 percent reimbursement, the Clerk-Recorder only received approximately $28,000

in revenues from the fees paid. In conjunction with increasing the fee to more

fully fund the Real Estate Fraud Prosecution Program, increasing the allowable

percentage deducted for reimbursing the Clerk-Recorder’s actual and necessary

administrative costs will also help close the deficits they face.

A one-time fee of under $10 to fund a

dedicated law enforcement team to investigate and prosecute real estate crime

is a tremendous value proposition for Orange County property owners. The

one-time fee, if increased from $3 to $8, remains small in the context of real

estate transactions often worth over a million dollars for even the average

transaction. Moreover, homeowners who may have never paid the fee or recorded a

document benefit from the program funded by the fee. However, a fee increase from $3 to $8 would

have a substantial positive impact on the Real Estate Fraud Prosecution Unit’s

ability to continue to investigate, prosecute, and deter real estate fraud in

the county. The Real Estate Fraud Prosecution Program has been running at a

deficit for several years and the additional funding would allow the program to

continue to operate at a high level. In

addition, the Courtesy Notice program, which allows for the early detection of

many real estate crimes, may not remain viable unless these funding deficits

are rectified.

The OCDA and Clerk-Recorder jointly

request Board approval of the increase of the $3 real estate fraud prosecution

fee to $8 on certain real estate instruments such as Grant Deeds, Quitclaim

Deeds, Deeds of Trust, Notices of Default, Notices of Trustee Sale, Trustee's

Deeds Upon Sale, and Mechanics’ Liens, for a three-year period beginning

October 1, 2024 following the adoption of the proposed resolution until September

30, 2027, when the fee comes up for renewal again, and in addition, increase

the cap on reimbursement for the Clerk-Recorder from five percent to ten

percent of the total fees collected for the same time period. The OCDA and the

Clerk-Recorder will have an opportunity at the next renewal to reevaluate the

fee amount and determine whether $8 continues to be the appropriate amount, or

whether changes in the real estate market necessitate raising or reducing the

fee.

This increased fee will provide the OCDA’s

specialized Real Estate Fraud Prosecution Unit with a necessary ongoing funding

source for the next three years to investigate, prosecute and deter real estate

fraud crimes as referenced in the Recommended Actions. Furthermore, this

increased funding will ensure the joint efforts of the OCDA and

Clerk-Recorder’s Courtesy Notice program – an important tool for combating real

estate fraud in the county – will continue.

Compliance with Proposition 26

The proposed fee does not fall within the

definition of a “Tax” under Proposition 26 because it is excepted by California

Constitution Article XIII C, Section 1, Subdivision (e)(3). Subdivision (e)(3)

excepts from the definition of tax, “a charge imposed for the reasonable

regulatory costs to a local government for issuing licenses and permits,

performing investigations, inspections, and audits, enforcing agricultural

marketing orders, and the administrative enforcement and adjudication thereof.”

This exception applies because the real estate fraud prosecution fees allocated

to the Real Estate Fraud Prosecution Program qualify as a statutory fee for the

deterrence, investigation, and prosecution of real estate fraud crimes. The

increased fees do not exceed the reasonable costs to the County for the Real

Estate Fraud Prosecution Program.

FINANCIAL

IMPACT:

N/A

STAFFING

IMPACT:

N/A

REVIEWING

AGENCIES:

Clerk-Recorder

ATTACHMENT(S):

Attachment

A - Real Estate Fraud Prosecution Unit Annual Report

Attachment B - Government Code Section 27388

Attachment C - Penal Code Section 115

Attachment D - Penal Code Sections 368 and 487

Attachment E - Real Estate Fraud Prosecution Fee - Draft Board Resolution

Attachment F - District Attorney Fee Checklist

Attachment G - Clerk-Recorder Fee Checklist

Attachment H - Notice of Public Hearing